What Does Paul B Insurance Do?

Wiki Article

The Ultimate Guide To Paul B Insurance

Table of ContentsPaul B Insurance - An OverviewThe Single Strategy To Use For Paul B InsuranceThe Of Paul B InsuranceThe 2-Minute Rule for Paul B InsuranceThe Greatest Guide To Paul B Insurance

The idea is that the cash paid out in claims over time will certainly be less than the overall costs accumulated. You may really feel like you're tossing cash out the window if you never sue, yet having item of mind that you're covered in the occasion that you do endure a substantial loss, can be worth its weight in gold.Envision you pay $500 a year to guarantee your $200,000 house. This means you've paid $5,000 for residence insurance coverage.

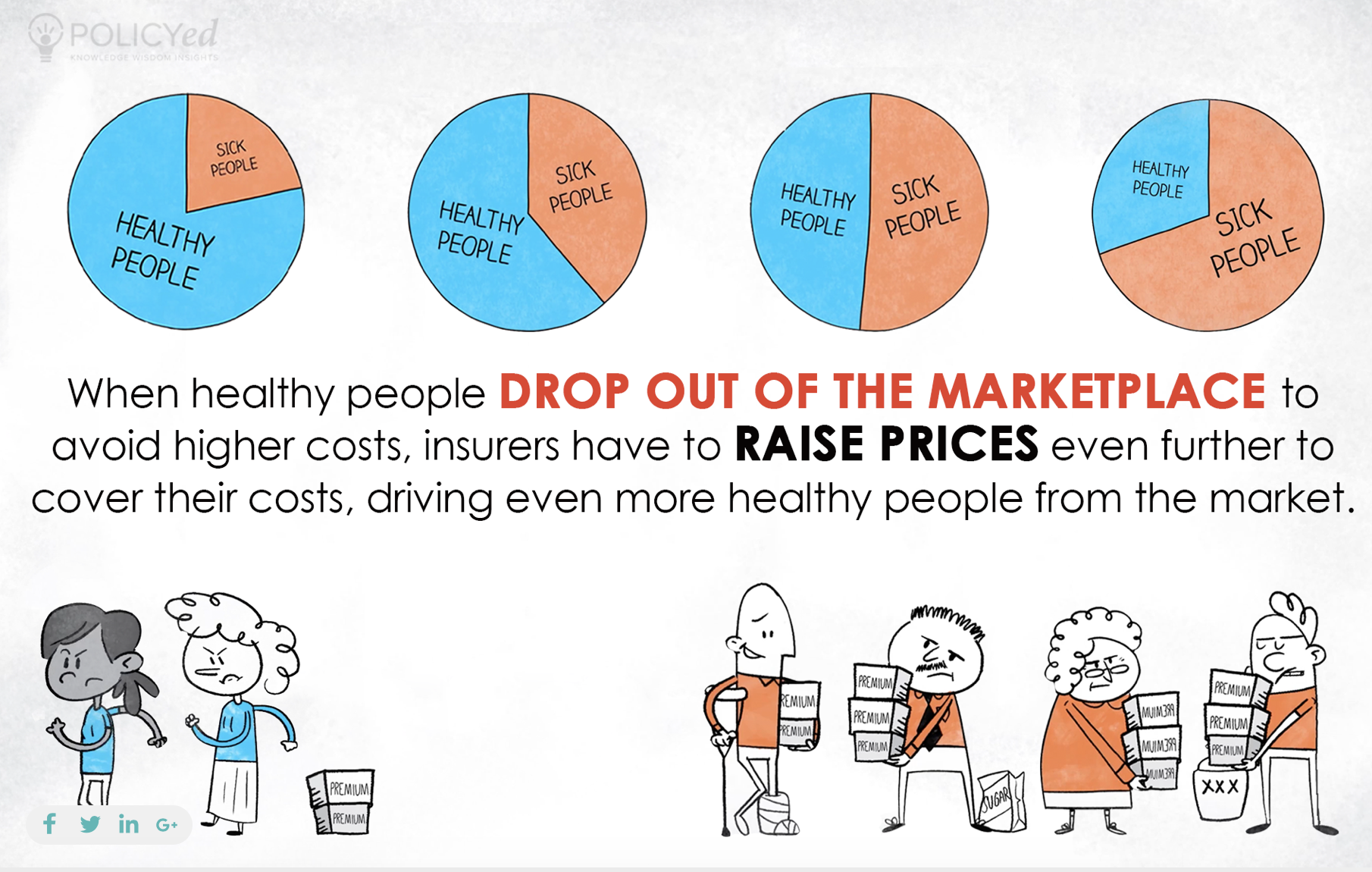

Due to the fact that insurance coverage is based upon spreading the threat among many individuals, it is the pooled cash of all individuals spending for it that enables the firm to develop properties and cover insurance claims when they take place. Insurance is an organization. Although it would behave for the companies to just leave prices at the very same level at all times, the fact is that they have to make sufficient cash to cover all the possible claims their insurance policy holders might make.

Some Known Incorrect Statements About Paul B Insurance

exactly how much they obtained in premiums, they must revise their rates to make money. Underwriting adjustments and price rises or declines are based upon outcomes the insurance policy business had in past years. Depending upon what business you buy it from, you may be dealing with a restricted representative. They market insurance policy from just one business.The frontline people you handle when you buy your insurance coverage are the representatives and brokers who represent the insurer. They will certainly discuss the kind of products they have. The restricted agent is an agent of only one insurer. They an aware of that business's products or offerings, however can not speak towards other business' plans, prices, or item offerings.

The Definitive Guide to Paul B Insurance

The insurance you require differs based on where you are at in your life, what kind of assets you have, and what your long term goals and duties are. That's why it is important to take the time to discuss what you want out of your policy with your representative.If you obtain a finance to buy an automobile, and after that something takes place to the vehicle, void insurance policy will repay any section of your lending that common auto insurance policy does not cover. Some lenders require their customers to carry void insurance policy.

6 Simple Techniques For Paul B Insurance

Life insurance policy covers the life of the insured individual. The insurance policy holder, who can be a various person or entity from the guaranteed, pays premiums to an insurance policy firm. In return, the insurance firm pays out a sum of money to the beneficiaries provided on the plan. Term life insurance coverage covers you for a period of time picked at purchase, such as 10, 20 or three decades.If you do not die during that time, no person makes money. Term life is you could look here preferred because it supplies big payments at a reduced expense than permanent life. It also provides insurance coverage for a set variety of years. There are some variations of normal term life insurance policy plans. Exchangeable plans enable you to convert them to long-term life policies at a higher premium, enabling longer and also possibly extra adaptable coverage.

Irreversible life insurance policy plans build money value as they age. The money worth of entire life insurance policy policies grows at a set price, while the cash money value within global plans can fluctuate.

The Definitive Guide to Paul B Insurance

If you contrast typical life insurance policy prices, you can see the difference. For instance, $500,000 of entire life coverage for a healthy and balanced 30-year-old woman expenses around $4,015 annually, on standard. That exact same degree of coverage with a 20-year term life policy would certainly cost approximately about $188 each year, according to Quotacy, a brokerage company.Nonetheless, those investments include even more danger. Variable life is an additional permanent life insurance policy choice. It appears a great deal like variable global life yet is actually different. It's an alternate to entire life with a set payment. Insurance holders can make use of financial investment subaccounts to expand the cash money worth of the plan.

Here are some life insurance coverage fundamentals to assist you much better look at here recognize just how insurance coverage functions. Costs are the payments you make to the insurance provider. For term life plans, these cover the cost of your insurance and administrative prices. With an irreversible plan, you'll likewise have the ability to pay money into a cash-value account.

Report this wiki page